Lagos, Nigeria – 21 June 2023 – Aradel Holdings Plc (“Aradel”, “Aradel Holdings”, “The Group”, or the “Company”), Nigeria’s first integrated indigenous energy Company, announces its audited results for the year ended 31 December 2022.

Strategic Update

-

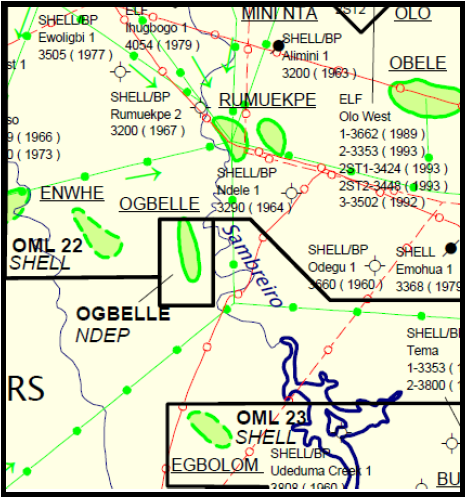

In March 2022, the Company commissioned front-end studies in anticipation of further development of the Ogbele Field. This culminated in a four-well drilling campaign that began in September 2022 and is expected to be completed in Q4, 2023.

- The Company is in the final stages of an upstream asset acquisition (and subsequent development) which is expected to be completed in 2023.

- Ms. Patricia Simon-Hart was appointed to the Board of the Company as an Independent Non-Executive Director, effective from the 4th of November 2022. Her appointment is in continuation of the Company’s ongoing, forward-looking preparations for the new challenges of growth and transformation as the emerging leading African energy Company.

- On the 19th of April 2023, as part of the Company’s rebranding, shareholders approved the change of name from Niger Delta Exploration & Production Plc to Aradel Holdings Plc.

- The Board recommends a final dividend of ₦35 per share, to be approved at the Annual General Meeting proposed to be held on the 29th of August 2023.

The Chief Executive Officer/Managing Director, Mr. Adegbite Falade, comments:

“The year 2022 was very tough for the oil and gas industry in Nigeria. Notwithstanding, because of our strong, resilient, and integrated business model, coupled with a focus on capital discipline and operating performance, the business recorded notable improvements. We increased revenue, EBITDA, and profit before tax year-on-year and achieved significant diversification of the revenue mix, underscored by very strong growth in the refinery business.

The four-well drilling campaign we commenced in Q3, 2022 is progressing well, and the benefits of the drilling and completion activities will become apparent over the course of 2023. We also completed a debottlenecking exercise that resulted in improved throughput from our refinery, as evidenced by the strong growth of our midstream operations. Additionally, our Alternative Crude Evacuation project became operational in the fourth quarter of 2022, and it is already creating an additional avenue for value creation to supplement evacuation through the Trans-Niger Pipeline. Each of these projects has the potential to deliver material returns on capital and further strengthen our production and cashflow generation.

To underscore our performance during the year, your Company is proposing to pay a dividend of ₦35 per share, a 75% increase over the ₦20 per share paid in 2021. This payment will be subject to the shareholders’ approval at the Annual General Meeting tentatively slated to hold on the 29th of August 2023.

In 2023, we expect further growth in our operations and associated revenue across our various business segments. “

Please click here to read the full press release.

Please click here to view the Audited Consolidated and Separate Financial Statements.