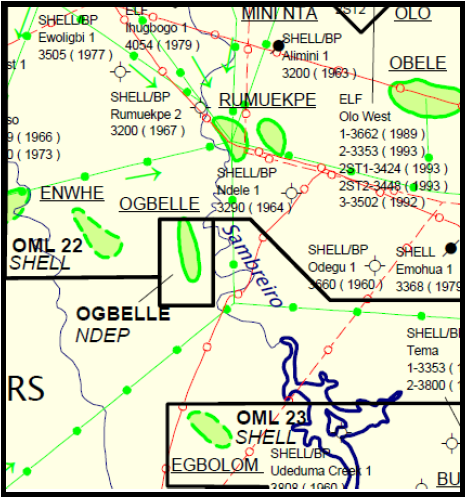

Following the registration of a ₦20 billion debt issuance programme (the “Programme”) with the Securities and Exchange Commission (“SEC”) of Nigeria, NDEP (the “Issuer”), Nigeria’s first integrated indigenous energy company operating across the entire value chain (upstream, midstream, and downstream) of the Nigerian Oil & Gas Industry, with shares traded on the National Association of Securities Dealers (NASD) Over the Counter (OTC) Securities Exchange, has received approval from the SEC for its ₦10.318 billion Series 1 Fixed Rate Senior Unsecured Bonds issue (the “Bonds” or “Issue”).

- A total of 61 Application Forms for 10,318,000 units of ₦1,000 each, valued at ₦10.318 billion were received in respect of the Issue. Therefore, the proposed ₦10 billion Series 1 17.0% Fixed Rate Senior Unsecured Bonds Issue was 3.18% oversubscribed.

- All Applications were valid, processed and accordingly considered in the allotment of the Bonds.

- Investor participation spanned qualified institutional investors, corporates, and high net-worth individuals (as defined in the Rules & Regulations of SEC), with an allocation of 98.7% to pension fund managers.

- The subscription demonstrated investor confidence in the NDEP brand, business model and long-term strategy, all supported by “A” rating from Agusto & Co. Limited, and an A+ rating from GCR Ratings.

- An application will be made to list the Bonds on the Financial Markets Dealers Quotations Exchange (the “FMDQ” or “Exchange”).

Commenting on the success of the issuance, the CEO of NDEP, Mr Adegbite Falade stated “We are thrilled to announce the success of the first series of Bonds issued under our Programme particularly the enormous interest shown by our investors. The act of diversifying our funding sources will further enhance our operational capacity and also enable us to attain our strategic goals and objectives as a company.”

The Basis of Allotment is set out below:

- 39 applications were received in the range of 1,000 – 100,000 units totalling 1,288,00 units and were fully allotted (12.48% of the units applied for);

- 17 applications in the range of 100,001 – 500,000 units totalling 4,630,000 units were received and fully allotted (44.87% of the units applied for); and,

- 5 applications for above 500,000 units totalling 4,400,000 units were partly allotted (42.65% of the units applied for).

The Bonds will be credited into the specified Clearing System Depository accounts of successful subscribers by the Registrar to the Issue, Coronation Registrars Limited.

The above stated Basis of Allotment has been cleared by the Securities & Exchange Commission.

Contact Information

Investors and analysts

Adegbola Adesina

Chief Financial Officer

Email: [email protected]

Investor Relations advisers

Værdi Investor Relations

Oluyemisi Lanre-Phillips

Media

Victoria Humphrey

Email: [email protected]